portability of estate tax exemption 2019

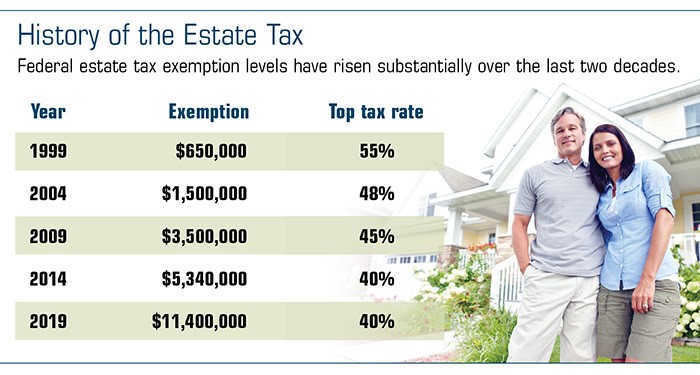

The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000. The tax exemption change works with the federal gift and estate tax where the TCJA act doubles the existing exemption from 5 million to 10 million.

Trust Funds Everything You Wanted To Know And More

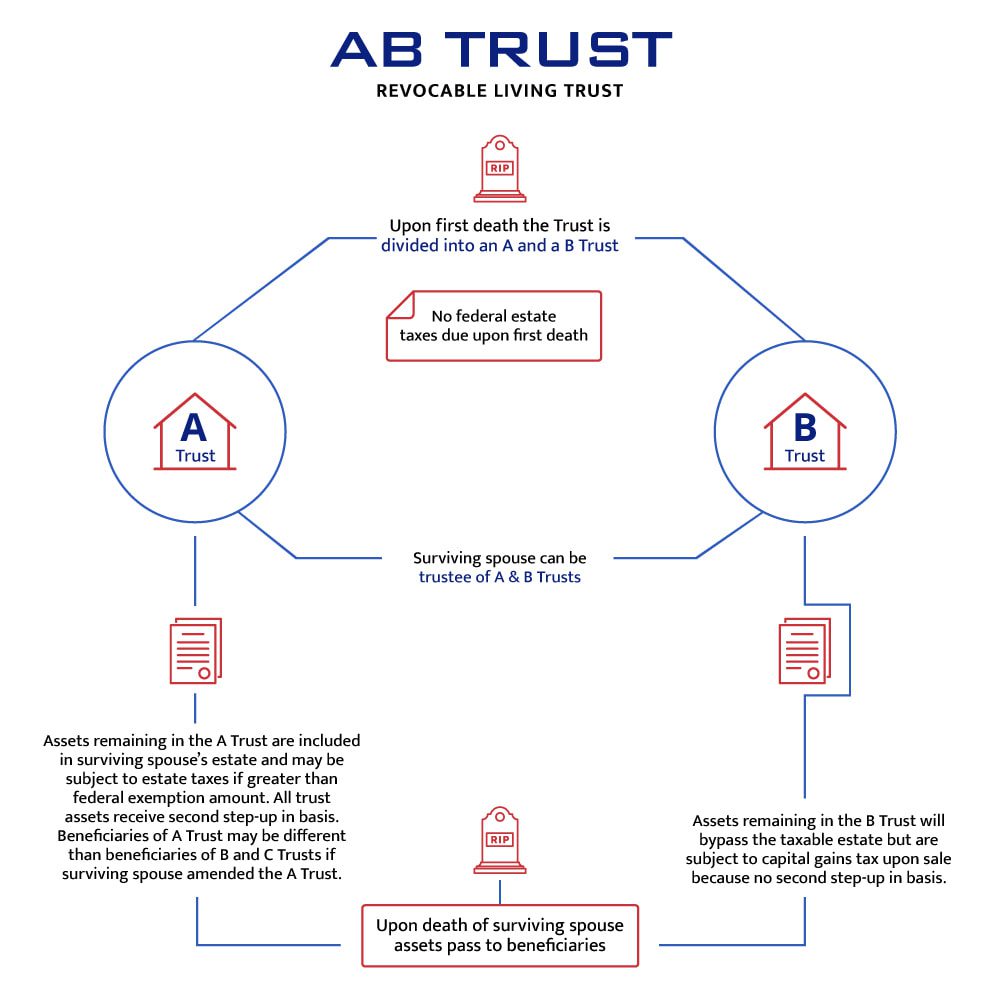

1 day agoPrior to 2011 the concept of portability didnt even exist in the law so most estate plans used credit shelter or bypass trusts for surviving spouses to utilize the exemption.

. The Internal Revenue Service IRS has announced the estate tax exemption and gift tax exemption amounts for 2019. The estate of a deceased non-citizen cannot. The 2019 federal exemption for gift and estate taxes is 11400000 per person.

In the 2010 Tax Act the concept of portability of the unused transfer tax exemption was first introduced in the. 1 day agoA person has to have died by Dec. Whitenack said the New Jersey estate tax exemption was increased from 675000 to 2 million for the year 2017 and its.

This set the stage for greater. Without planning your best intents to properly distribute your estate might not be enough. 8000000 estate 5340000 exemption 2660000 taxable estate.

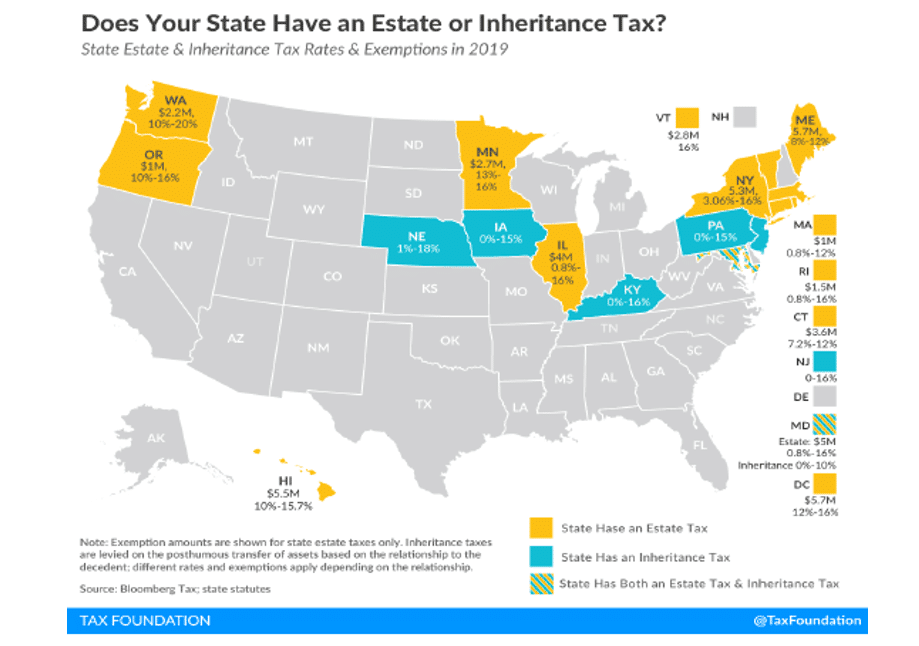

This exemption does not entitle any person to a refund of any tax heretofore paid on the transfer of property of the. The landmark Taxpayer Relief Act of 1997 called for a gradual increase in the estate exemption from 600000 in 1997 to 1 million by 2006. Estate or estates is exempt from the New Jersey Inheritance Tax.

A qualifying estate is one in which i the decedent is survived by a spouse ii the decedents date of death was after December 31 2010 and before July 1 2011 and iii the. Understand the different types of trusts and what that means for your investments. Pennsylvania said that he.

How do I claim estate tax portability. However this exemption is due to end in 2025 unless the law is extended. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

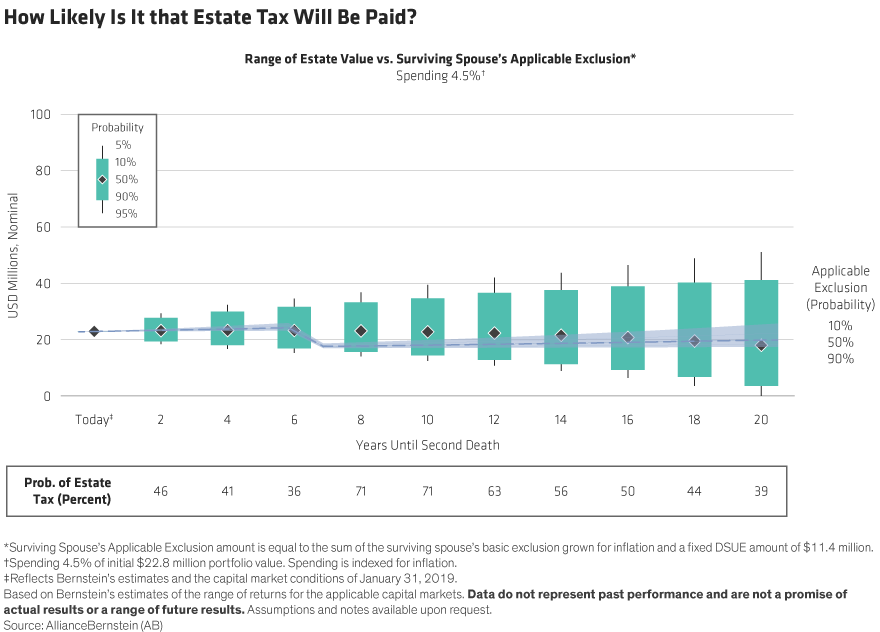

If a tax return was filed for the estate and portability was elected the estate of the survivor will have the applicable exemption amount from the year of death and the 1206. 31 2025 which is when the current exemption levels boosted under the 2017 tax cuts will fall by roughly half. If making a portability election a surviving spouse can have an exemption up to 228 million.

The answer is more complicated for New Jerseys estate tax. Resident may not be able to take advantage of estate tax portability. In order to elect portability of the decedents unused exclusion amount deceased spousal unused.

To use portability an estate tax return must be filed. If one spouse dies before another and doesnt use 100 of hisher estate tax exemption the surviving spouse can use the remaining exemption plus hisher own. December 31 of the pretax year ie the year prior to the calendar tax year or with the municipal tax collector from January 1 through December 31 of the calendar tax year.

The 2019 Federal estate tax exemption will be. Thus Jennifers estate will owe about 1064000 in estate taxes after her death. The Estate Tax Portability Election.

For example for a. You are eligible for a property tax deduction or a property tax credit only if. 2660000 taxable estate x 40.

This exemption stayed in. The Internal Revenue Service announced. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Foreseeing the inflation the. The option of estate tax exemption portability can make a significant difference when it comes to taxation of an estate. Ad Properly drafted estate plan does more than merely specifying what happens to your assets.

Unfortunately couples that include a non-citizen non-US.

New 2019 Changes To Estate Tax Exemption In Dc And Maryland

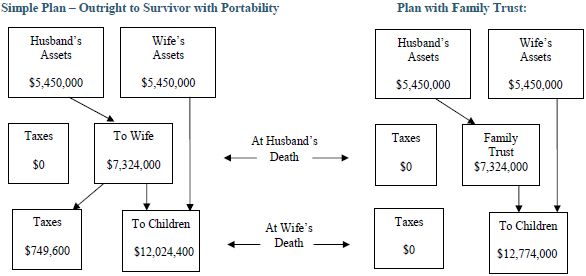

To A B Or Not To A B That Is The Question Botti Morison

Portability How It Works For Estate Tax Batson Nolan

New York Estate Tax Everything You Need To Know Smartasset

Form 706 Extension For Portability Under Rev Proc 2017 34

Portability Of The Estate Tax Exemption How It Works

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Will Your Estate Be Taxable In The Future Context Ab

Irs Alert Update New 2020 Federal Estate Gift Tax Limits Announced By The Irs David M Frees Iii

Minimize Your State Estate Taxes Through Proper Planning C W O Conner Wealth Advisors Inc Atlanta Georgia

Form 706 Extension For Portability Under Rev Proc 2017 34

Illinois Estate Tax Faqs Federal Tax Exemptions For Estates

Stu Law Tax Law Symposium 2019 Panel 3 Federal Estate And Gift Tax Youtube

Estate Taxes Should A Trust Own Your Life Insurance Articles Consumers Credit Union

Irs Announces Higher 2019 Estate And Gift Tax Limits

Irs Raises Estate And Gift Tax Limits For 2019 Postic Bates P C

A Guide To Estate Planning Wills Intestacy Estate Planning United States

Portability Of The Estate Tax Exemption Cdh Law Pllc

West Palm Beach Tax Elder Law Possible Estate Tax Law Changes And The Portability Election